“We

have to work with the world,” Rouhani said Thursday, in what amounted

to a plaintive, hour-long defense of his legacy at the nation’s central

bank. To opponents who argue that Iran can succeed in isolation,

ignoring the impact of foreign policy choices, he said: “Well, I don’t

know how to do that.”

The response was swift. “The revolutionary

youth know how. With the help of people anything is possible,”

Mohammadbagher Ghalibaf, a former Tehran mayor, ex-Revolutionary Guard

officer and three-time presidential candidate, wrote in a tweet.

Many conservatives interpret Khamenei’s ambiguous calls for a “resistance

economy” to mean adjustment to sanctions through import substitution,

coupled with reliance on China and Russia for investment and technology

transfers.

The catch is that sanctions are only part of the

problem in a country with sometimes difficult business conditions and a

weak private sector, according to Cyrus Razzaghi, president of Ara

Enterprise, a business consultancy in Tehran. Nor can China alone

provide all the funds and technologies Iran requires to prosper.

“What’s

needed is really massive structural reforms to make Iran more

productive, with or without sanctions,” he said. “To be honest, I don’t

see any manifesto or real policy to address these issues.”

represent. The debate over how to do that is already raging.

represent. The debate over how to do that is already raging.

The central bank said last week it was taking action to

make it easier for private companies to export. Private companies are

responsible for much of the $40 billion worth of non-oil goods Iran is

still managing to send abroad annually, securing vital hard currency,

the bank said.

In many ways, the surprise is that Iran’s economy

has survived as well as it has. The rial has stabilized after losing

more than half its value when Trump pulled out of the nuclear deal in

2018. Middle class Iranians are scraping by.

Without dramatic

external or internal relief for the economy, this resilience can’t last

forever, Razzaghi said. He puts the limit somewhere in 2021. That

economic fragility also means Iran “can’t afford further military escalation” with the U.S., Ziad Daoud of Bloomberg Economics said.

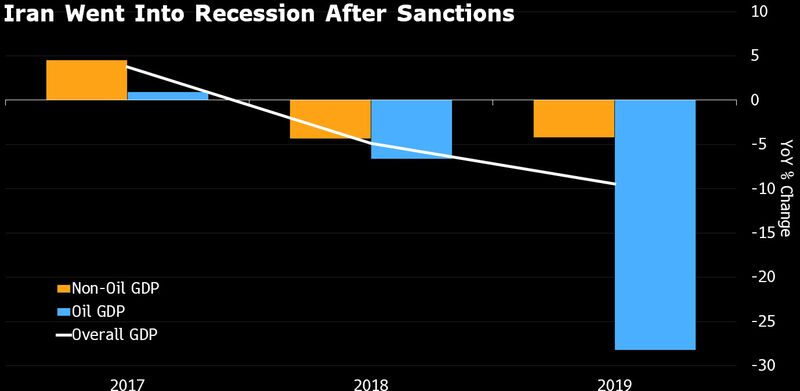

The

economy has been badly damaged by the renewed sanctions, reimposed at a

time when a lower oil price was in any case squeezing government

revenue. During the last U.S.-led sanctions campaign against Iran,

before the 2015 nuclear deal, former President Mahmoud Ahmadinejad

showered the population with handouts. That was made possible largely by

an oil price around $120 per barrel. Oil has been closer to $60 per

barrel for much of Rouhani’s term.

https://www.bloomberg.com/news/articles/2020-01-20/iran-s-bid-to-integrate-with-global-economy-is-coming-to-an-end